DAP

Delivery at (Place of Destination)

Explained

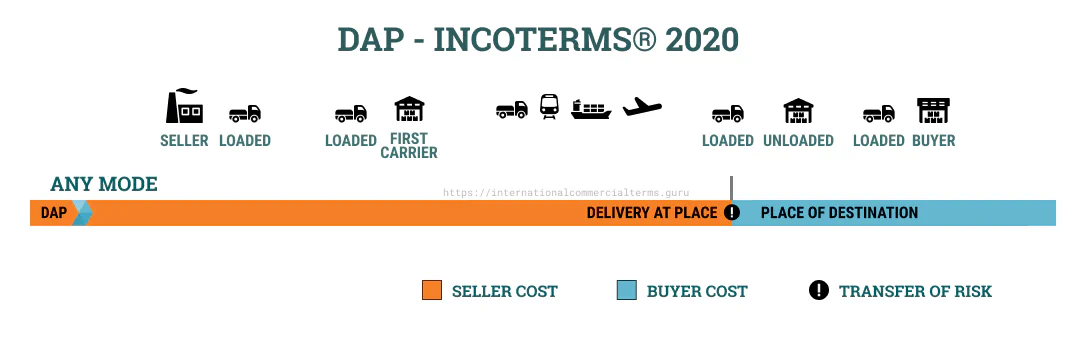

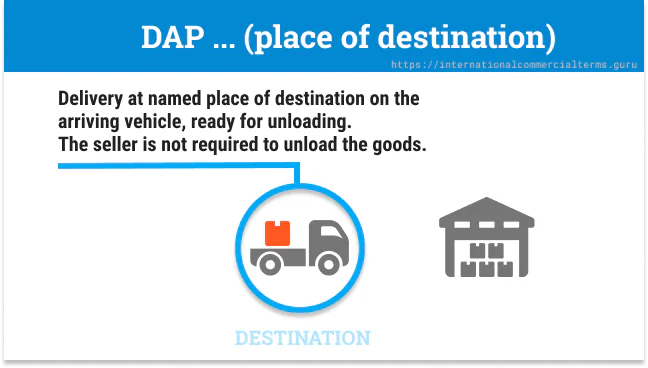

In DAP, the seller is responsible for getting the goods from the origin to the agreed-upon delivery point, where the buyer can unload them. The seller is responsible for the goods until they reach the agreed delivery point. The seller cannot charge the buyer for unloading the goods. This term can be used for any mode of transportation.

Doing Business

DAP means the seller delivers the goods to the agreed destination. The seller does not have to unload the goods. It can be used for any mode of transportation. The seller pays for export customs, and the buyer pays for import customs, duties, and taxes. The seller delivers the goods unloaded from the vehicle.

This term reduces the risk of the seller delivering goods to the first port of entry unloaded. The seller and buyer must agree on the delivery place.

Examples

DAP Patagonia Clothing Warehouse, 222 Central Ave, Ventura, CA, USA - Incoterms® 2020Seller and Buyer obligations

| THE SELLER’S OBLIGATIONS | THE BUYER’S OBLIGATIONS |

|---|---|

| A1. General The seller must deliver the goods, commercial invoice, and any evidence of conformity. | B1. General The buyer must pay the price of goods as agreed. |

| A2. Delivery Deliver the goods at the disposal of the buyer, unloaded. On the agreed date or period. | B2. Taking Delivery* The buyer takes the goods at the destination point. |

| A3. Risks All risk of loss/damage until goods have been delivered. | B3. Risks All risk of loss/damage from the time or end of the period agreed for delivery. If the buyer fails to clear import customs or notify time/period, the risk is under the buyer. |

| A4. Carriage Contract carriage of goods until the place of destination. | B4. Carriage No obligation to contract a carrier. |

| A5. Insurance No obligation. | B5. Insurance No obligation to insure the goods. |

| A6. Delivery/transport document Provide documents that allow the buyer to take over the goods. | B6. Delivery/transport document Accepts the proof of delivery |

| A7. Export/Import clearance All export clearance expenses (license, security, inspection, etc). Assist with import clearance | B7. Export/Import clearance Assist with export clearance. Pay for import clearance and formalities (licenses, security, official documentation). |

| A8. Checking The seller must check, count, weight, mark, and package goods | B8. Checking No obligation. |

| A9. Allocation of cost Pay all the cost until delivery. Transport and loading. Unloading charges that are under the contract of carriage only. Transit costs. Cost of delivery/transport document. Duties and taxes for export. All costs related to providing assistance in obtaining documents to the buyer. | B9. Allocation of cost Pay from the time goods delivered. Unloading. All costs for assistance. Pay duties and taxes for imports. Any additional cost if does not notify the shipment date or period. |

| A10. Notices Give the notice to receive the goods. | B10. Notices Time or period for receiving the goods and name the point of receiving the goods. |

FAQ about DAP

How does DAP differ from DDP?

The only difference between DAP and DDP is:

- DAP: Risk and costs of import clearance lie with the buyer

- DDP: Risk and costs of import clearance lie with the seller

Both require:

- A named place of delivery to be specified

- Delivery is completed when goods arrive at that place NOT UNLOADED

How should freight be treated for customs clearance under DAP?

Expert answer:

- If DAP destination terminal: The invoice price is effectively the same as CIP terminal

- If DAP buyer’s premises: The seller’s price includes domestic components (THC, domestic transport from terminal to destination, return of empty container for FCL) which should NOT be included in the value for duty

Within the EU: Customs value amounts to the value of the goods at their point of entry in the EU. Inland transport fees within the EU can be deducted to calculate the customs amount.