DDP

Delivery Duty Paid (Place of Destination)

Explained

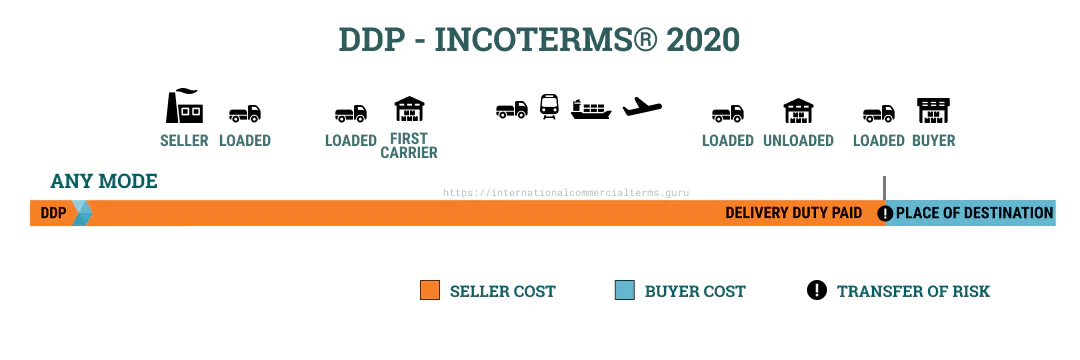

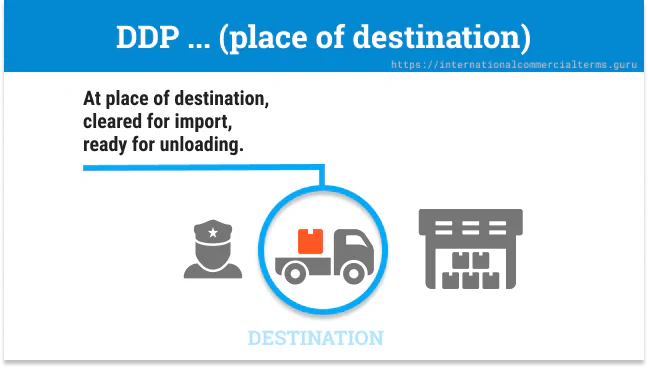

The seller is responsible for all costs until the goods are delivered to the buyer at the destination. The seller doesn’t pay for unloading in DDP. Name the place of destination exactly. This term can be used for any mode of transportation. The seller must be able to clear customs at the destination.

Doing Business

The seller delivers goods until the final point agreed with the buyer, with customs clearance paid and goods unloaded. It’s the riskiest for the seller. The seller must pay all taxes and charges. No insurance is needed, and it can be shipped by any method. The seller must know what to do when selling up to the final destination with all expenses covered. This is usually for items like courier, where the full supply chain cost is under control.

Examples

Courier delivery of online purchases:

DDP 445 Ocean Road, Sydney, Australia - Incoterms® 2020Seller and Buyer obligations

| THE SELLER’S OBLIGATIONS | THE BUYER’S OBLIGATIONS |

|---|---|

| A1. General The seller must deliver the goods, commercial invoice, and any evidence of conformity. | B1. General The buyer must pay the price of goods as agreed. |

| A2. Delivery Deliver the goods at the disposal of the buyer on the arriving vehicle, ready for unload. On the agreed date or period. | B2. Taking Delivery The buyer takes the goods at the destination point. |

| A3. Risks All risk of loss/damage until goods have been delivered. | B3. Risks All risk of loss/damage from the time or end of the period agreed for delivery. If the buyer fails to assist the import clearance, the risk is under the buyer. |

| A4. Carriage Contract carriage of goods until the place of destination. | B4. Carriage No obligation to contract a carrier. |

| A5. Insurance No obligation. | B5. Insurance No obligation to insure the goods. |

| A6. Delivery/transport document Provide documents that allow the buyer to take over the goods. | B6. Delivery/transport document Accepts the proof of delivery |

| A7. Export/Import clearance All export and import clearance expenses (license, security, inspection, etc). | B7. Export/Import clearance Assist with import clearance. |

| A8. Checking The seller must check, count, weight, mark, and package goods | B8. Checking No obligation. |

| A9. Allocation of cost Pay all the cost until delivery. Transport and loading. Unloading charges only if related to the contract of carriage. Cost of delivery/transport document. Duties and taxes for export and import. | B9. Allocation of cost Pay from the time goods delivered. Any additional cost if does not notify the time for taking delivery or fails to assist the seller for import clearance. |

| A10. Notices Give the notice to receive the goods. | B10. Notices Time or period for receiving the goods and name the point of receiving the goods. |

FAQ about DDP

Is DDP really a “door-to-door” delivery term?

No. The term “door-to-door” has no official definition in Incoterms - the word “door” isn’t even mentioned in the Incoterms 2020 book.

Both DAP and DDP require a named place of delivery to be specified. The only difference between DAP and DDP concerns import clearance responsibilities and related costs - not the location of delivery.

When should DDP be used?

Expert recommendation (Johnatas Montezuma): AVOID DDP AT ALL COSTS, OR IT MIGHT COST YOU DEARLY!

DDP is problematic and should be avoided in almost all circumstances, especially for cross-ocean transactions. Here’s why:

Legal issues:

- In many countries, only entities registered/domiciled in that country can act as importer of record

- The seller (foreign company) often cannot legally import clear the goods

- Example: Brazil and many other countries don’t allow non-resident companies to be importers

- Within the EU: non-EU sellers may face VAT registration problems

- Imports into USA allow the importer of record to be a foreign entity, but this is not common globally

- Reference: https://www.flexport.com/help/176-foreign-importer-of-record/

Practical risks:

- Customs brokers may make import declarations in the buyer’s name without their knowledge or authorization

- This has led to legal cases where buyers were held liable for duties and violations they didn’t know about

- Example case in Australia (Studio Fashions) where this exact scenario occurred

Better alternatives: Use DAP or other terms that don’t require the seller to handle import clearance in the destination country.

Who is responsible for unloading under DDP?

Under Incoterms 2020 DDP, the seller is NOT responsible for unloading at the named place of delivery. Only DPU (Delivered at Place Unloaded) explicitly requires the seller to unload.

Delivery under DDP is completed when goods arrive at the named place of delivery, NOT unloaded, ready for unloading by the buyer.

Key points:

- Unloading costs fall on the buyer unless they are included in the seller’s contract of carriage

- This can be a source of disputes since the buyer bears the unloading risk even though the seller arranged transport

- Any costs for setting down/unloading equipment are buyer’s responsibility

Who pays Container Detention Charges under DDP?

This depends on:

- The precise named place of delivery

- The root cause of the detention

- What was agreed in the sales contract

General principle: DDP Incoterms 2020 makes no mention of containers nor imposes any obligation on the seller to return empty containers. It is common practice for shipping lines to charge demurrage and detention charges to the consignee of the goods in the Bill of Lading.

If the named place is the destination terminal: The buyer would be responsible for taking the container from that terminal and returning it, as delivery by the seller would have occurred when the container was made available at the terminal, import cleared.

Important note: The question can only be answered once all facts are known. Incoterms don’t deal with the implications of the contract of carriage that contains details about detention charges.

Other considerations:

- If the named place is the buyer’s premises, the seller may need to arrange for container

- Take note of free days of demurrage and detention to avoid unexpected costs

- Clearly define responsibilities in the sales contract to avoid disputes

- Under DDP the buyer is not responsible for import clearance, but they may still be liable for detention if they fail to return the container on time.

- The buyer might be responsible for customs fines or penalties with government authorities if they fail to comply with import regulations, even though the seller handled the import clearance.