CFR

Cost and Freight (named port of destination)

Explained

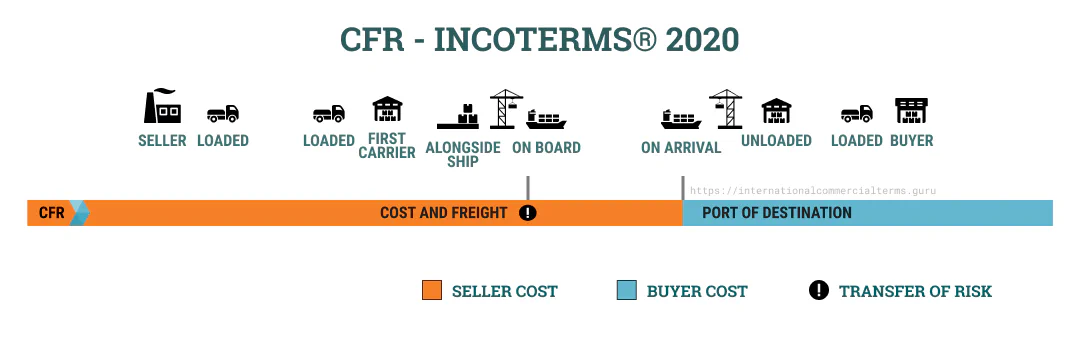

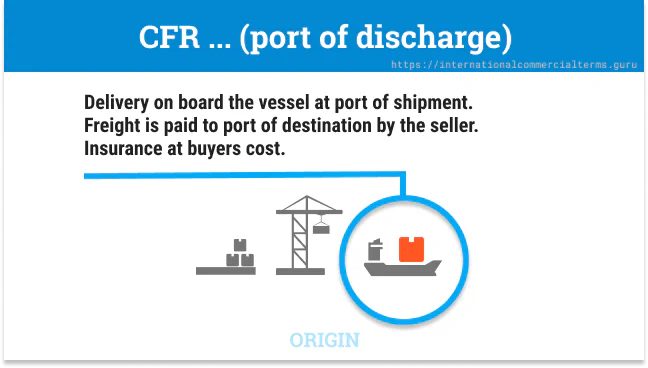

In CFR, the seller bears the responsibility for delivering the goods to the port of export and ensuring that they are duly cleared for export. The seller bears the financial responsibility for the transportation of the goods until the final port of destination. However, the transfer of risk occurs when the goods are on board.

This term is used in ocean and inland waterway transportation. The contract must specify the exact port of discharge, whereas the port of loading is optional. The risk and delivery occur at the port of loading. The seller is responsible for covering the cost of freight until the port of discharge. The buyer is responsible for covering the costs associated with discharge and import clearance.

Doing Business

The seller is not liable for loss after the goods leave the port of origin. The seller must also arrange international shipping and provide the buyer with all the necessary documents. The seller must also clear customs. The seller arranges transportation at the buyer’s risk. The buyer should get insurance.

This term is only used for waterway transportation. This term is used for agricultural or chemical products where the seller has expertise and can arrange loading and transportation until the port of discharge. Use CPT for containerized shipments. This term is used for large or unusual cargo.

The usual transport document is a bill of lading with the date it was created. A bill of lading allows the buyer to transfer goods in transit. The bill of lading is proof of shipment for letters of credit or payments.

The buyer is responsible for unloading costs unless the contract of sale says otherwise.

If a carrier has multiple legs and transshipment points, delivery usually happens at the first port of loading. For example, the first leg is Jakarta to Singapore, the second is Singapore to Long Beach, California.

Examples

Buying chemicals from China: CFR Port of Rotterdam - Incoterms® 2020Seller and Buyer obligations

| THE SELLER’S OBLIGATIONS | THE BUYER’S OBLIGATIONS |

|---|---|

| A1. General The seller must deliver the goods, commercial invoice, and any evidence of conformity. | B1. General The buyer must pay the price of goods as agreed. |

| A2. Delivery Deliver the goods by placing on board the vessel in the agreed date or period. In the customary manner at the port | B2. Taking Delivery The buyer takes the goods from the carrier at the port of destination |

| A3. Risks All risk of loss/damage until goods have been delivered | B3. Risks All risk of loss/damage from the time or end of the period agreed for delivery. If the buyer fails to give note of the port of destination, the risk is under the buyer. |

| A4. Carriage Contract carriage of goods until port of destination. | B4. Carriage No obligation to contract a carrier. |

| A5. Insurance No obligation. Provide at buyers risk and cost, any required information. | B5. Insurance No obligation to insure the goods. |

| A6. Delivery/transport document Provide the usual transport document. | B6. Delivery/transport document Accepts the proof of delivery |

| A7. Export/Import clearance All export clearance expenses (license, security, inspection, etc). Assist with import clearance | B7. Export/Import clearance Assist with export clearance. Pay for import clearance and formalities (licenses, security, official documentation). |

| A8. Checking The seller must check, count, weight, mark, and package goods | B8. Checking No obligation. |

| A9. Allocation of cost Pay all the cost until delivery, freight cost, and loading cost. Unloading cost if agreed in the contract. Transit costs. Cost of proof of delivery. Duties and taxes for export. All costs related to providing assistance in obtaining documents to the buyer | B9. Allocation of cost Pay from the time goods delivered. All costs for assistance on getting carriage, insurance, delivery, and customs documentation. Pay duties and taxes for import or transit. Any additional cost if the carrier is not nominated or carrier fails to collect goods. |

| A10. Notices Give notice that goods have been delivered on board. | B10. Notices Time or period for receiving the goods and name the port of destination. |

FAQ about CFR

Why does the seller pay for transport under CFR but the buyer bears the risk?

A similar answer applies to CIF as to CFR.

This reflects historical practice from the 1800s. CFR (via its predecessor C&F) pre-dates the first set of Incoterms rules.

Historical context: Imagine in the 1800s, a seller contracts with a ship-owner to transport goods from A to B but doesn’t want marine risks while goods are on the high seas. The seller (likely already paid in cash before shipment) agrees to load goods onto the ship and pay the freight, but not bear the ocean risk.

Modern reality: The confusion often comes from the word “responsibility,” which is interpreted as including risk. Incoterms never use this word. Under CFR/CIF:

- Seller must pay the freight

- Buyer bears all risks of loss/damage once goods are loaded on board in the port of shipment

- Depending on the buying power of buyer/seller, the party with more power to get ocean freight rates often negotiates who pays for freight

- Example: a large mobile distributor selling to small retailers may have the leverage to negotiate better ocean freight rates than the small retailers. In this case, the large distributor may agree to pay for freight (CFR/CIF) even though the small retailers bear the risk. The ocean freight contract is under the Seller’s name and bill of ladings are consigned to the small retailers. It is a mutually beneficial arrangement for seller and buyer to have a competitive freight rate.

When should I use CFR?

Use CFR when:

- Shipping by water (ocean or inland waterways)

- The seller is better able to arrange and pay for ocean freight than the buyer

- The buyer is willing to bear the risk of loss/damage once goods are loaded on board