CIP

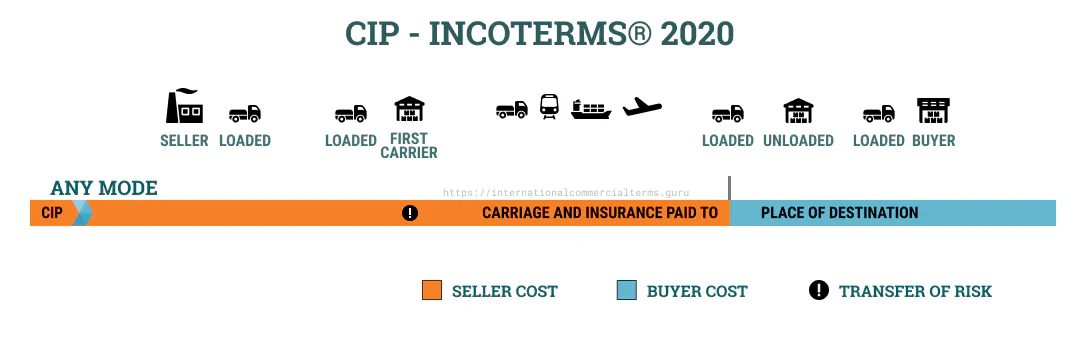

Carriage and Insurance paid to (Place of Destination)

Explained

The seller clears the goods for export and delivers them to the carrier. The seller pays for shipping, but is not liable after shipment. The seller must get insurance to the named place of destination. The buyer can get extra insurance. The risk is passed when the goods are received by the carrier. This term can be used for any mode of transportation.

Doing Business

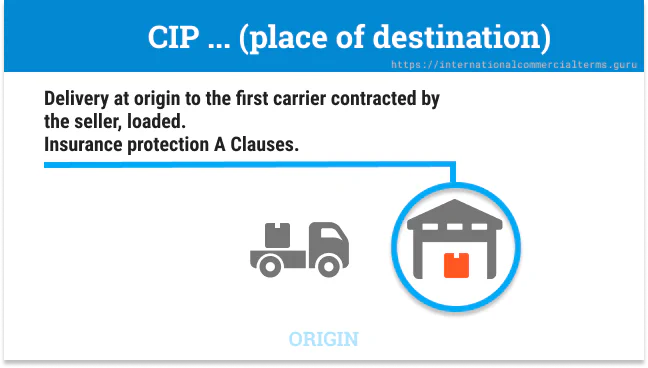

The seller pays for shipping and insurance. The seller pays for insurance, which is often acceptable for bulk cargo, but not for manufactured goods or high-value merchandise. “All-risk” insurance is extensive. The seller gets insurance for the buyer’s risk. The seller pays for freight until the final destination. Delivery happens at the origin with the first carrier. The seller arranges export clearance for any mode of transportation.

The buyer can claim with the insurance company if there is a problem. For CIP and CPT, the destination can be a different location like a warehouse or truck terminal. Freight costs more when delivered at the port or a destination warehouse. The buyer clears customs. If there are delays at the origin, the buyer and seller usually discuss the additional expenses.

Examples

Mobile phones from Taiwan to Australia:

CIP Keilor Park warehouse of Mobile Distributors, Melbourne, Australia - Incoterms® 2020Mobile phones will be shipped by air from Taiwan to Melbourne Airport. After customs, a seller-nominated forwarder will transport the goods to the Mobile Distributor’s warehouse. The seller pays for airport terminal handling and transfer fees. The buyer pays for customs and duties.

Seller and Buyer obligations

| THE SELLER’S OBLIGATIONS | THE BUYER’S OBLIGATIONS |

|---|---|

| A1. General The seller must deliver the goods, commercial invoice, and any evidence of conformity. | B1. General The buyer must pay the price of goods as agreed. |

| A2. Delivery Deliver the goods to the carrier on the agreed date or period. | B2. Taking Delivery The buyer takes the goods from the carrier at the place of destination or at the point. |

| A3. Risks All risk of loss/damage until goods have been delivered. | B3. Risks All risk of loss/damage from the time or end of the period agreed for delivery. If the buyer fails to give notice of the place of destination, the risk is under the buyer. |

| A4. Carriage Contract carriage of goods until the place of destination. | B4. Carriage No obligation to contract a carrier. |

| A5. Insurance Insure the goods at maximum. | B5. Insurance No obligation to insure the goods. |

| A6. Delivery/transport document Provide the usual transport document and dated within the agreed shipment period. Full set of originals if the document is negotiable. | B6. Delivery/transport document Accepts the proof of delivery |

| A7. Export/Import clearance All export clearance expenses (license, security, inspection, etc). Assist with import clearance | B7. Export/Import clearance Assist with export clearance. Pay for import clearance and formalities (licenses, security, official documentation). |

| A8. Checking The seller must check, count, weight, mark, and package goods | B8. Checking No obligation. |

| A9. Allocation of cost Pay all the cost until delivery. Transport and loading. Unloading under the contract of carriage. Transit costs. Cost of proof of delivery. Insurance. Duties and taxes for export. All costs related to providing assistance in obtaining documents to the buyer | B9. Allocation of cost Pay from the time goods delivered. Transit cost not under sellers account. Unloading cost not related to the contract of carriage. Additional insurance not under the seller account. All costs for assistance. Pay duties and taxes for imports. Any additional cost if does not notify the shipment date or period. |

| A10. Notices Give notice that goods have been delivered. | B10. Notices Time or period for dispatching the goods and name the point of receiving the goods. |

FAQ about CIP and CPT

Where does risk transfer under CPT/CIP?

Risk transfers when the seller delivers goods to the seller’s carrier (not at the destination).

For containerized shipments (Expert insight from Bob Ronai, member of the Incoterms 2020 Drafting Group):

- FCL: Risk passes when delivery is made to seller’s carrier, usually at seller’s premises. Ocean freight services starting at Door of Seller or services starting at the container yard (CY).

- LCL: Same - typically at seller’s premises

- Even if seller delivers to carrier’s depot, delivery occurs when vehicle arrives ready for unloading, which could be hundreds of kilometers from the actual port. This is usually a warehouse or cargo freight station where cargo is received for loading into containers.

Critical point: Both CPT and CIP fail to clearly explain delivery to the carrier. In practice, delivery works exactly the same as FCA - it can be at seller’s premises or at carrier’s place.

Is the seller responsible for loading costs under CPT/CIP?

Yes, but where matters:

The seller retains risk for CPT and CIP exactly as for FCA. The only difference is:

- FCA: Buyer’s carrier (explained clearly in the rules)

- CPT/CIP: Seller’s carrier (clarity was needed but not provided in Incoterms 2020)

What does “physical possession in the manner appropriate to the means of transport used” mean?

This confusing wording from CPT/CIP Article A2 caused debate even among the Drafting Group members.

What it means in practice: The manner of handing over goods to the carrier depends on the transport mode and type:

- Container at seller’s premises: goods loaded into container

- LCL at seller’s premises: goods loaded onto truck

- At carrier’s depot: goods arrive on seller’s transport ready for carrier to unload