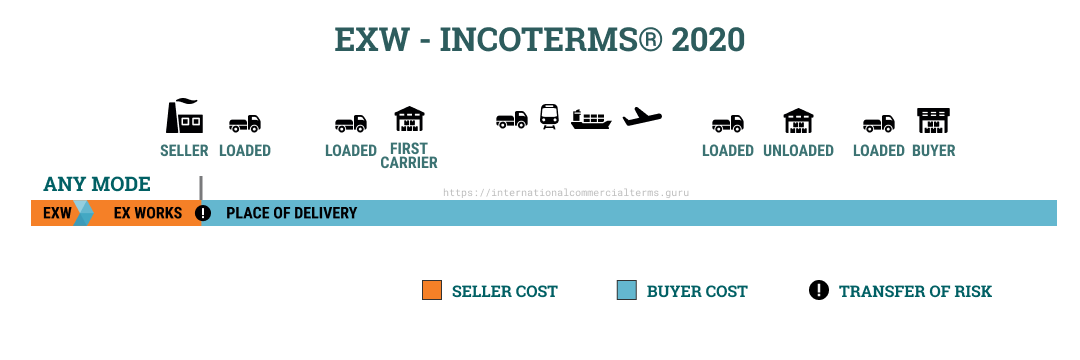

EXW – Ex Works (Place of Delivery) - Incoterms 2020

Explained

Ex-works terms make the seller responsible to place the goods at the disposal of the buyer at the seller’s facilities or any other named place. The named place can be other than the seller premises. Delivery occurs when goods are placed for the buyer’s disposal without necessarily to be loaded. If the loading operation is performed by the seller, it is difficult for the buyer to assume any responsibility. A good alternative for the buyer is to choose FCA.

This rule can be used for any mode of transport.

EXW terms do not obligate the seller to clear exports or load goods into the collecting vehicle.

Depending on local practice, the seller can load goods into transport vehicles if agreed by mutual parties. In other cases, where the buyer wants to avoid additional loading fees, the buyer arranges the loading with their own equipment or manually (i.e. loading of goods by hand). If the buyer is not able to clear customs on origin, it is recommended to use FCA Place of Receipt.

Doing Business

EXW represents the minimum obligation to the seller and the seller’s obligations end when goods are placed at disposal to the buyer. Usually, EXW is used when a seller is not willing to be responsible for the movement of goods to other warehouses or ports. It is common practice for the seller to load goods into the vehicle.

With this term, the seller has a minimum obligation and the buyer must bear all costs and risks involved in pick up and transportation of goods from the seller’s premises. This term can have one variation that mentions explicitly that the seller must clear customs or load goods into the vehicle and its similar to the FCA term.

Examples

Buying fruits in Costa Rica:

EXW Finca La Fortuna, Heredia, Costa Rica - Incoterms® 2020

Buying goods at free trade zone:

EXW Shanghai Free Trade Zone, Sony Warehouse, China - Incoterms® 2020

Seller and Buyer obligations

This is the term with less risk for the seller. Goods are delivered at the agreed place and there is no obligation for the seller to load goods into the vehicle. However, it is common practice to agree on loading at the buyer’s expense and risk.

The seller must provide and collaborate with all documentation for export and insurance.

| THE SELLER’S OBLIGATIONS | THE BUYER’S OBLIGATIONS |

|---|---|

| 1. General The seller must deliver the goods, commercial invoice, and evidence of conformity |

1. General The buyer must pay the price of goods as agreed in the contract of sale |

| 2. Delivery Deliver the goods at the agreed point, date or period, not loaded on vehicle |

2. Taking Delivery The buyer takes the goods after delivered and given notice received from the seller |

| 3. Risks All risk of loss/damage until goods have been delivered |

3. Risks All risk of loss/damage from the time or end of the period agreed for delivery |

| 4. Carriage No obligation to make a contract of carriage. Provide at buyers risk and cost, information for arranging carriage |

4. Carriage Contract the carriage from the place of delivery |

| 5. Insurance No obligation. Provide at buyers risk and cost, any required information. |

5. Insurance No obligation to insure the goods. |

| 6. Delivery/transport document No obligation. |

6. Delivery/transport document Provides evidence of taken delivery to the seller. |

| 7. Export/Import clearance Assist the buyer (at buyers risk and cost) obtaining documents for export/transit/import. |

7. Export/Import clearance Arrange and pay any documents for export/transit/import |

| 8. Checking The seller must check, count, weight and package goods |

8. Checking No obligation. |

| 9. Allocation of cost Pay all the cost until delivery |

9. Allocation of cost Pay from the time goods delivered. Reimburse cost to the seller for assisting with information. Pay duties and taxes for export |

| 10. Notices Give notice so the buyer can take the delivery |

10. Notices With sufficient notice, the buyer can agree on time and place of delivery. |