DDP – Delivery Duty Paid (Place of Destination) - Incoterms 2020

Explained

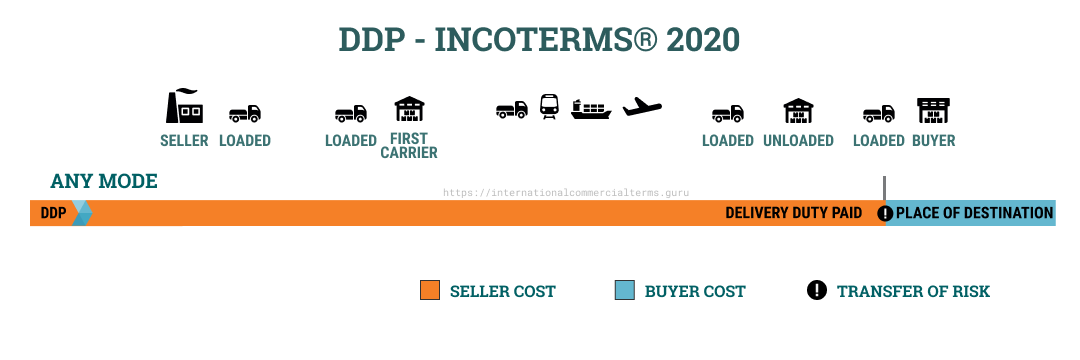

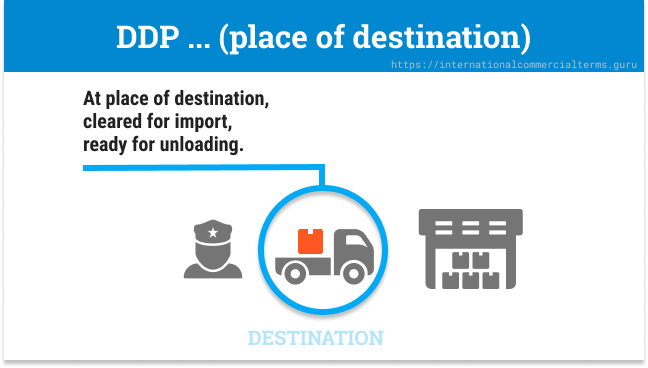

Under DDP the seller is responsible for all costs associated until the seller delivers the goods to the buyer, cleared for import at the named place of destination. In DDP the seller does not pay for unloading the goods. It is important to mention the exact name of the place of destination. This term can be used for any mode of transportation including multimodal. The term is used under the assumption that the seller is capable of clear customs at the destination.

Doing Business

For this term, the seller delivers goods until the final point agreed with the buyer with customs import clearance paid and goods unloaded. It represents the maximum risk for the seller. The seller must pay all duties, taxes, VAT and other destination charges. It doesn’t require any party for insurance and can be used for any mode of transportation.

In practice, the seller must know what to do when selling up to the final destination with all expenses covered. It is usually applicable for items like courier where the full supply chain cost is under control and with minimum cost variance.

Examples

Courier delivery of online purchases:

DDP 445 Ocean Road, Sydney, Australia - Incoterms® 2020

Seller and Buyer obligations

| THE SELLER’S OBLIGATIONS | THE BUYER’S OBLIGATIONS |

|---|---|

| 1. General The seller must deliver the goods, commercial invoice, and any evidence of conformity. |

1. General The buyer must pay the price of goods as agreed. |

| 2. Delivery Deliver the goods at the disposal of the buyer on the arriving vehicle, ready for unload. On the agreed date or period. |

2. Taking Delivery The buyer takes the goods at the destination point. |

| 3. Risks All risk of loss/damage until goods have been delivered. |

3. Risks All risk of loss/damage from the time or end of the period agreed for delivery. If the buyer fails to assist the import clearance, the risk is under the buyer. |

| 4. Carriage Contract carriage of goods until the place of destination. |

4. Carriage No obligation to contract a carrier. |

| 5. Insurance No obligation. |

5. Insurance No obligation to insure the goods. |

| 6. Delivery/transport document Provide documents that allow the buyer to take over the goods. |

6. Delivery/transport document Accepts the proof of delivery |

| 7. Export/Import clearance All export and import clearance expenses (license, security, inspection, etc). |

7. Export/Import clearance Assist with import clearance. |

| 8. Checking The seller must check, count, weight, mark, and package goods |

8. Checking No obligation. |

| 9. Allocation of cost Pay all the cost until delivery. Transport and loading. Unloading charges only if related to the contract of carriage. Cost of delivery/transport document. Duties and taxes for export and import. |

9. Allocation of cost Pay from the time goods delivered. Any additional cost if does not notify the time for taking delivery or fails to assist the seller for import clearance. |

| 10. Notices Give the notice to receive the goods. |

10. Notices Time or period for receiving the goods and name the point of receiving the goods. |