EXW

Ex Works (Place of Delivery)

Explained

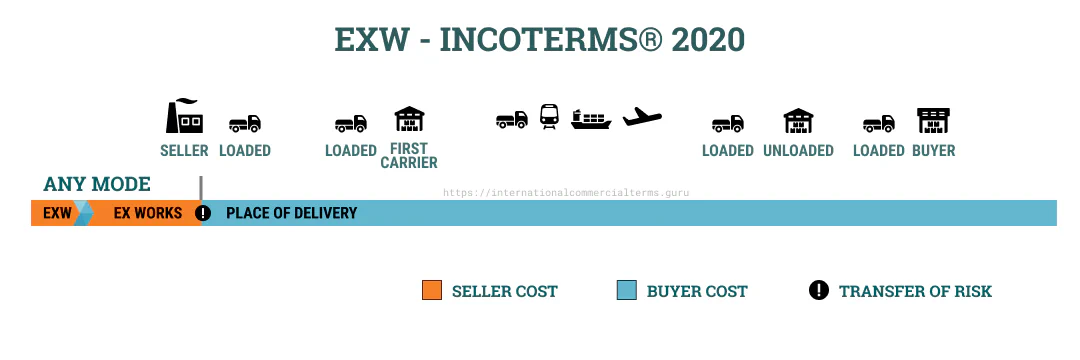

Ex-works terms mean the seller must deliver the goods to the buyer at the seller’s facilities or another agreed location. The place can be other than the seller’s premises. Delivery is when the buyer can take the goods. If the seller loads the goods, the buyer cannot be held responsible. Buyers can choose FCA.

This rule can be used for any mode of transport.

EXW terms don’t obligate the seller to clear exports or load goods into the collecting vehicle.

The seller can load goods into transport vehicles if agreed by both parties. If the buyer wants to avoid additional loading fees, the buyer arranges the loading with their own equipment or manually. If the buyer can’t clear customs on origin, it is recommended to use FCA Place of Receipt.

Doing Business

EXW represents the minimum obligation of the seller, and the seller’s obligations are considered to be fulfilled upon the transfer of the goods to the buyer. The EXW term is typically employed when the seller is not inclined to assume responsibility for the subsequent movement of goods to alternative warehouses or ports. It is customary for the seller to load the goods into the vehicle.

In this case, the seller is responsible for a minimum level of obligation, while the buyer is responsible for all costs and risks associated with the pickup and transportation of the goods from the seller’s premises. This term can also be modified to explicitly require the seller to clear customs or load the goods into the vehicle, which is similar to the FCA term.

Examples

Buying fruits in Costa Rica:

EXW Finca La Fortuna, Heredia, Costa Rica - Incoterms® 2020Buying goods at free trade zone:

EXW Shanghai Free Trade Zone, Sony Warehouse, China - Incoterms® 2020Seller and Buyer obligations

This is the term with less risk for the seller. Goods are delivered at the agreed place and there is no obligation for the seller to load goods into the vehicle. However, it is common practice to agree on loading at the buyer’s expense and risk.

The seller must provide and collaborate with all documentation for export and insurance.

| THE SELLER’S OBLIGATIONS | THE BUYER’S OBLIGATIONS |

|---|---|

| A1. General The seller must deliver the goods, commercial invoice, and evidence of conformity | B1. General The buyer must pay the price of goods as agreed in the contract of sale |

| A2. Delivery Deliver the goods at the agreed point, date or period, not loaded on vehicle | B2. Taking Delivery The buyer takes the goods after delivered and given notice received from the seller |

| A3. Risks All risk of loss/damage until goods have been delivered | B3. Risks All risk of loss/damage from the time or end of the period agreed for delivery |

| A4. Carriage No obligation to make a contract of carriage. Provide at buyers risk and cost, information for arranging carriage | B4. Carriage Contract the carriage from the place of delivery |

| A5. Insurance No obligation. Provide at buyers risk and cost, any required information. | B5. Insurance No obligation to insure the goods. |

| A6. Delivery/transport document No obligation. | B6. Delivery/transport document Provides evidence of taken delivery to the seller. |

| A7. Export/Import clearance Assist the buyer (at buyers risk and cost) obtaining documents for export/transit/import. | B7. Export/Import clearance Arrange and pay any documents for export/transit/import |

| A8. Checking The seller must check, count, weight and package goods | B8. Checking No obligation. |

| A9. Allocation of cost Pay all the cost until delivery | B9. Allocation of cost Pay from the time goods delivered. Reimburse cost to the seller for assisting with information. Pay duties and taxes for export |

| A10. Notices Give notice so the buyer can take the delivery | B10. Notices With sufficient notice, the buyer can agree on time and place of delivery. |

FAQ about EXW

What is the difference between EXW and FCA?

EXW (Ex Works) places the minimum obligation on the seller, who only needs to make the goods available at their premises. FCA (Free Carrier) requires the seller to deliver the goods to a carrier nominated by the buyer at a specified location. With FCA, the seller handles export clearance, while with EXW, the buyer is responsible for all export formalities.

When should EXW be used?

Expert recommendation: EXW is inappropriate in almost all circumstances. It is only suitable when the buyer can handle all export formalities and logistics, usually through a freight forwarder. Under EXW, the seller is not required to send shipping instructions or assist with export documentation, which can lead to complications. When buyers decide to use EXW, export customs clearance and booking services are required from a third party, often resulting in higher costs and delays.

Problems with EXW:

- Risk and costs pass from seller to buyer even before goods are collected

- In most countries (other than maybe the EU), the buyer cannot be the exporter

- The unwitting buyer may unknowingly become the exporter of record without the ability to fulfill export obligations